How to Build an Emergency Savings Fund in the UK (Even on a Budget)

Life throws spanners in the works. From a surprise car repair to a sudden illness, unexpected expenses can wreak havoc on your finances. That's where an emergency savings fund comes in – your financial safety net to catch you when things go belly up.

A staggering one-third of working-age families in the UK, rising to nearly half of low-income families, lack even a basic emergency savings cushion of £1,000 according to the Resolution Foundation.

Why's an Emergency Savings Fund Important?

Imagine this: your washing machine conks out just as your car needs a new tyre. Without an emergency fund, you might be forced to:

- Rack up credit card debt: High-interest credit card debt can quickly spiral out of control.

- Dip into your long-term goals: Raiding your pension savings can have serious long-term consequences.

- Stress over every little unexpected expense: Financial anxiety can take a toll on your mental well-being.

An emergency savings fund provides peace of mind. It allows you to handle unexpected costs without jeopardising your financial future or racking up debt on the plastic.

But How Do I Save When Money's Already Tight?

Building an emergency fund might seem daunting, especially when you're living from one payday to the next. But even small steps can make a big difference. Here are some tips to get you started:

- Start Small: Aim for a manageable amount – even £20 a week adds up. Track your progress to stay motivated!

- Review Your Spending: Identify areas where you can cut back. Maybe it's that daily takeaway coffee or unused subscriptions? Every penny saved is a penny towards your emergency fund. ✂️

Pro Tip: Use the free online Budget Planner by MoneyHelper to get started. It's simple to use and also gives personalised tips!

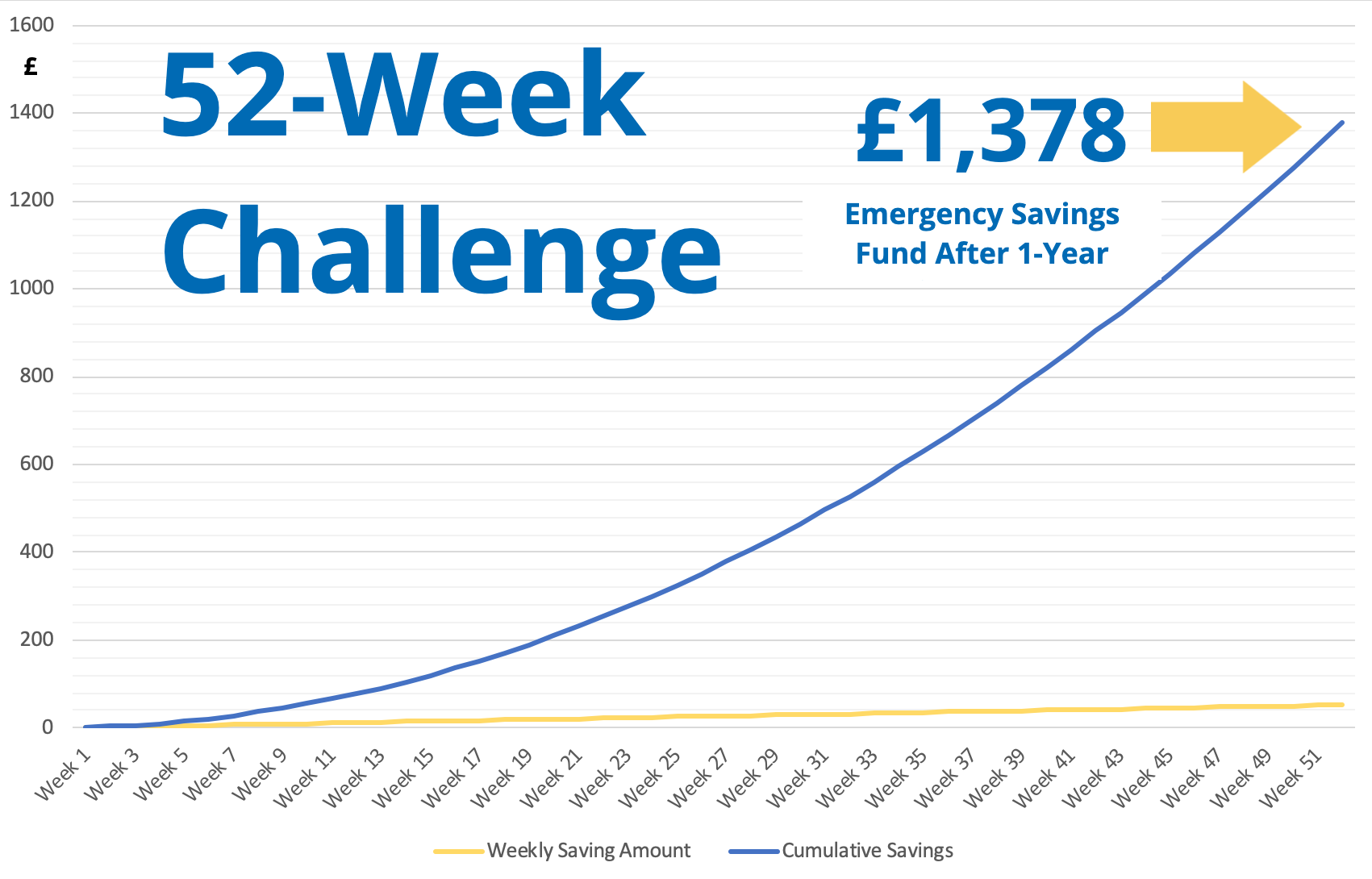

- The 52-Week Challenge: Give the 52-week challenge a go! Start by saving £1 in week 1, £2 in week 2, and so on. By the end of the year, you'll have saved over £1300!

- Sell Unused Items: Do you have clothes or gadgets gathering dust? De-clutter and turn unwanted bits and bobs into cash through online marketplaces, such as Vinted, or car boot sales. Find your nearest car boot sale at findcarboot.co.uk

Did you know? Vinted wasn't just voted the best marketplace to buy second-hand clothes in Which? magazine, as we highlighted in our 'Treasure Hunt on a Budget' post, it also came out on top for selling your unwanted items!

- Automate Savings: Set up a standing order to your savings account each payday. This "set it and forget it" approach ensures you save consistently.

- Beat Inflation: Earn interest with top-rated easy-access savings accounts. See Which?'s latest table toppers.

Remember: Every little bit counts! Even a small emergency fund can make a massive difference in a time of need. Once you've built a basic emergency fund (ideally 3-6 months of living expenses), you can start focusing on other financial goals like saving for a house deposit or paying off debt in full.

Take control of your finances and build your safety net. Start saving for your emergency fund today.

Was this article helpful? Share with friends and family

Subscribe today to join our exclusive Stepsave community and receive our Money Uncovered newsletter!