The Magic of Making Money Make Money: The Power of Compounding

"Compound interest is the eighth wonder of the world"

Albert Einstein

Ever heard the saying "money makes money"? Well, there's a powerful financial concept behind it: compounding. It's not magic, but it can feel pretty close when you see how it grows your savings over time.

Here at Stepsave, we're all about helping you reach your financial goals. And compounding is one of the best tools you've got in your arsenal.

So, how does it work? Let's say you invest £1,000 at a 5% annual interest rate (APR). That means you'll earn £50 in interest after a year. Now, here's the magic part: in year two, you don't just earn interest on the original £1,000. You earn interest on the total amount, which includes the first year's interest! That means in year two, you'll earn interest on £1,050 (£1,000 + £50).

It might seem like a small difference at first, but this process keeps snowballing over time.

Real-Life Example

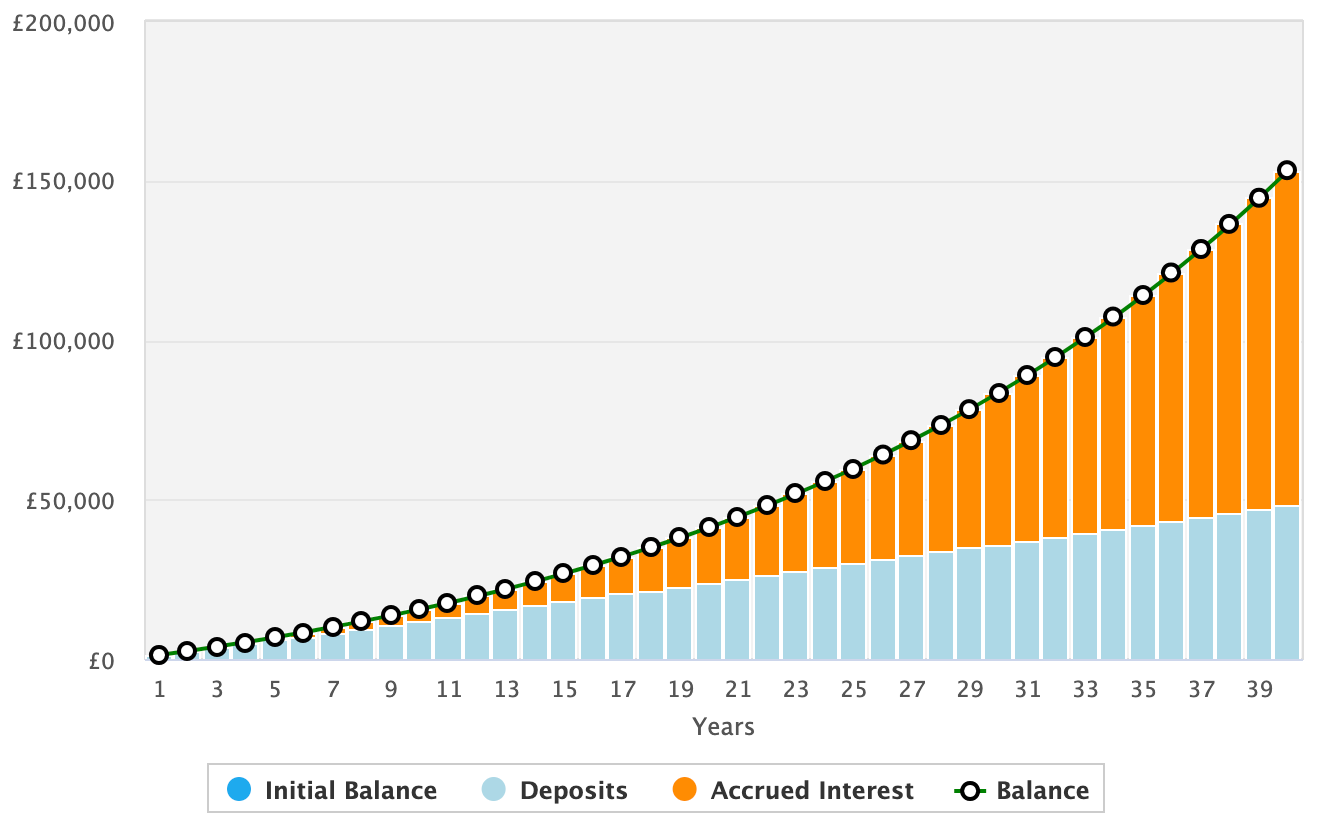

Imagine you're 25 years old and you want to save for the future for when you'll be 65. You decide to start saving £100 every month into a savings/investment account with a 5% average annual return (remember, past performance is not a guarantee of future results).

Here's what happens:

- By the time you reach 65, you would have contributed a total of £48,000 (£100 x 12 months/year x 40 years).

But thanks to compounding, your nest egg could be much bigger!

- With a 5% average annual return, your total savings could be worth approximately £153,000!

That's a whopping £105,000 more than you actually put in – all thanks to the power of compounding!

Source: thecalculatorsite.com

Pro Tip:

Try the compound interest calculator over at

thecalculatorsite.com. This way, you can play around with different scenarios and see how much your savings can grow over time.

The Key Takeaways

The earlier you start saving and investing, the more time your money has to grow through compounding. Even small contributions can make a big difference over the long term.

Here are some key takeaways:

- The earlier you start, the greater the impact of compounding.

- Consistency is key! Regularly contributing smaller amounts can be more effective than a large lump sum later.

- Don't underestimate the power of small increases. Even a slight rise in your interest rate or contribution amount can significantly boost your final sum.

Remember, the sooner you start, the sooner your money can start making you money!

Why Compounding Matters Even More with Inflation

While the example above showcased the impressive growth from compounding, it's crucial to consider inflation. Inflation, as we've all experienced recently, is the rise in the cost of living over time. This means a pound today won't buy you the same things in the future, especially in decades like retirement.

Here's how inflation can affect your future savings:

- Over time, inflation erodes the purchasing power of your money. This means a seemingly large sum today might not hold the same value when you need it most.

So, where does compounding come in? Even with inflation, compounding can still be a powerful tool:

- If your investment return is higher than the inflation rate, your money will still grow in real terms (meaning, considering inflation). In simpler terms, your money grows faster than prices increase.

The Call to Action

This is why starting to save early and aiming for a higher return on your investments (within your risk tolerance) is crucial. By leveraging compound interest, you can help ensure your retirement savings keep pace with inflation and maintain your purchasing power in the future.

Looking to learn more about maximising your money with tax-efficient accounts (such as ISAs and SIPPs) and low fees? Stay tuned for our upcoming articles that will delve deeper into these topics and help you get the most out of compounding!

Was this article helpful? Share with friends and family

Subscribe today to join our exclusive Stepsave community and receive our Money Uncovered newsletter!